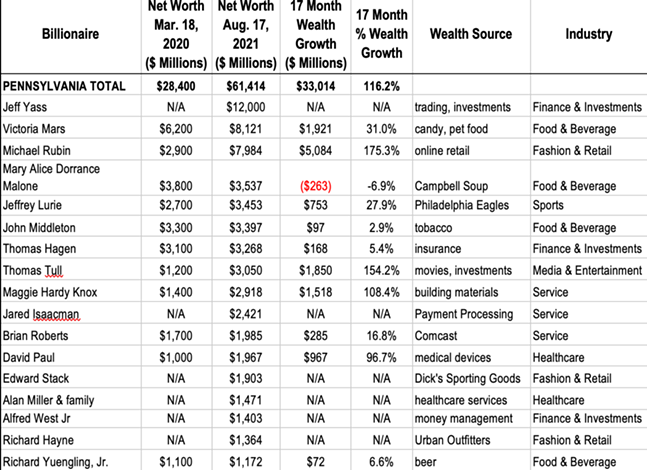

The state’s 17 billionaires more than doubled their wealth during the pandemic, watching it grow by $33 billion, or 116%, from $28.4 billion in March 2020 to $61.4 billion through Aug. 17 of this year, the analysis showed.

The report calls on members of Pennsylvania’s congressional delegation to support the $3.5 trillion budget resolution now before lawmakers on Capitol Hill, and pay for it by taxing the wealthiest Americans and corporations.

The document “shows why we need the entire state congressional delegation to support President [Joe] Biden’s Build Back Better Plan being debated in Washington right now,” Antoinette Kraus, the executive director of the Pennsylvania Health Access Network, one of the groups behind the report, said in a statement.

Biden’s proposal will “invest $3.5 trillion in working families and our communities by making the rich and corporations pay their fair share of taxes. It will provide the funding we need to create thousands of good-paying jobs in Pennsylvania and help people afford healthcare, eldercare, childcare, education, housing and more,” Kraus continued.

Other organizations involved in the report include Americans for Tax Fairness, Health Care for America Now, and the Pennsylvania Budget & Policy Center.

Below, a look at the wealthiest Pennsylvanians, and how their wealth grew during the pandemic.

The world’s wealthiest individuals saw their fortune increase by 54%, even as millions of people were thrown out of work, losing health coverage and other benefits as the pandemic raged, the analysis showed.

“Between March 18, 2020, and March 18, 2021, the wealth held by the world’s billionaires jumped from $8.04 trillion to $12.39 trillion, according to the IPS’ analysis of data from Forbes, Bloomberg, and Wealth-X,” CBS News reported.

As is the case with the Pennsylvania report, the release of that data in March of this year prompted calls for the nation’s wealthiest people, who saw their taxes dramatically cut during the prior Trump administration, to shoulder a greater financial burden through a wealth tax.

In their statement, the Pennsylvania advocates note that if a wealth tax proposed by U.S. Sen. Elizabeth Warren (D-Mass.) had been in effect in 2020, “the nation’s billionaires alone would have paid $114 billion for that year — and would pay an estimated combined total of $1.4 trillion over 10 years.”

Despite polling data showing public support for increased taxes on the wealthy, some experts believe it could have the opposite of its intended effect by harming the growth prospects of lower income people, or by encouraging the wealthy to off-shore their interests to shelter them from increased taxation, CBS News reported.

“A wealth tax would have a negative impact on the economy. It would reduce national income, discourage saving and encourage consumption,” among other downsides, Tax Foundation economist Erica York wrote in a March blog post. according to CBS News.

The data the Pennsylvania groups released Wednesday showed that U.S. billionaire wealth grew by 62%, or by $1.8 trillion, during the pandemic, rising from $2.95 trillion in March 2020 to $4.77 trillion through Aug. 17. The group counts 708 billionaires in the United States.

Taxing that wealth would pay for more than half of Biden’s 10-year, $3.5 trillion package, they argued.

“It’s time Pennsylvania billionaires and big corporations step up to the plate and pay their fair share,” Jeff Garis, who coordinates the Pennsylvania Budget & Policy Center’s “99% Pennsylvania Campaign,” said in a statement.

“It’s time that lawmakers prioritize working people by rewarding work not wealth and closing huge tax loopholes,” Garis continued, adding that Biden’s “plan levels the playing field and ensures that everyone in America, not just the rich and corporations, can get a fair shot at a good-paying job, affordable health care and a real opportunity at a better future.”

The Democratic administration’s plans won’t “raise taxes on anyone earning under $400,000, meaning that 99% of Americans and 97% of small business owners won’t pay any more in taxes while the rich and corporations will finally pay a fairer share,” Garis concluded.

John Micek is the Editor-in-Chief of the Pennsylvania Capital-Star, where this story first appeared.