Thursday, April 12, 2018

Two Southwestern Pennsylvania Republicans will see thousands in extra income thanks to tax-cut bill loophole

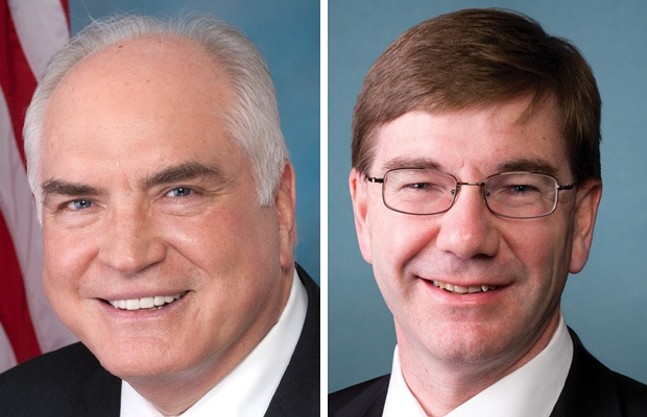

Since the late 2000s, many congressional Republicans have been critical of the country’s rising national debt. By the early 2010s, a cavalcade of Republican candidates swept into the U.S. House on the message of “fiscal responsibility,” including local U.S. Reps like Mike Kelly (R-Butler) and Keith Rothfus (R-Sewickley).

But those budget-deficit concerns appeared to be thrown out the window when representatives like Kelly and Rothfus and voted for the big tax-cut bill last year. According to a recent report from the nonpartisan Congressional Budget Office, the national budget deficit will be $1.85 trillion higher over the next 10 years than previously projected thanks to the tax-cut bill.

And on top of that, analysis of the tax cuts show that benefits will disproportionately go to the country's wealthiest citizens, and won’t lead to much improvement for low- to middle-income earners. But that doesn’t mean the Congressional Republicans who backed the tax bill will see many negative effects in their personal finances. In fact, a new study shows that U.S. Reps like Kelly and Rothfus will personally reap thousands of dollars in benefits every year thanks to the tax cuts.

The Center for American Progress (CAP), a progressive policy advocacy organization, published a paper on April 10, looking at how much each U.S. Rep and U.S. Senator who supported the tax cut bill would benefit from a loophole written into the bill for "pass-through businesses." The loophole allows certain business earnings, like from real-estate holding, to be taxed at a lower rate than before.

Thanks to this loophole, Rothfus will see up to $7,650 in additional income each year, according to the paper, and Kelly will see up to $15,100. In total, the 53 representatives listed in the paper will receive about $15 million in additional income each year. (It should be noted that both Rothfus and Kelly are well below average in how much extra money they will see from the loophole, compared to the other 51 representatives listed in the study.) But Kelly does sit on the Ways and Means committee in the U.S. House, which crafted the original legislation and actually proposed a bigger pass-through deduction than was eventually passed.

Nonetheless, CAP Action spokesperson Jesse Lee sent a statement to City Paper saying the outcome was corrupt because the tax bill provides direct financial benefits to those who voted for it.

“Every day we see a new example of the Republican culture of corruption, but the tax bill was the crowning achievement,” wrote Lee in a statement. “Like Trump’s cabinet, members of congress who voted for this are enriching themselves at the expense of the middle class, and they should all come clean on just how much they gave themselves.”

Requests for comments to the offices of Kelly and Rothfus went unanswered.

CAP’s study also points out that a typical employee isn't eligible for the pass-through deduction and that small business owners could have a tough time figuring out how to benefit thanks to

“a thicket of confusing new rules.”

Other Pennsylvania politicians to vote for the tax bill and see significant personal-income benefits are U.S. Rep. Tom Marino (R-Williamsport), who will get up to $15,300 in extra annual income, and U.S. Rep. Lou Barletta (R- Hazleton), who will see up to $7,650 more.

But those budget-deficit concerns appeared to be thrown out the window when representatives like Kelly and Rothfus and voted for the big tax-cut bill last year. According to a recent report from the nonpartisan Congressional Budget Office, the national budget deficit will be $1.85 trillion higher over the next 10 years than previously projected thanks to the tax-cut bill.

And on top of that, analysis of the tax cuts show that benefits will disproportionately go to the country's wealthiest citizens, and won’t lead to much improvement for low- to middle-income earners. But that doesn’t mean the Congressional Republicans who backed the tax bill will see many negative effects in their personal finances. In fact, a new study shows that U.S. Reps like Kelly and Rothfus will personally reap thousands of dollars in benefits every year thanks to the tax cuts.

The Center for American Progress (CAP), a progressive policy advocacy organization, published a paper on April 10, looking at how much each U.S. Rep and U.S. Senator who supported the tax cut bill would benefit from a loophole written into the bill for "pass-through businesses." The loophole allows certain business earnings, like from real-estate holding, to be taxed at a lower rate than before.

Thanks to this loophole, Rothfus will see up to $7,650 in additional income each year, according to the paper, and Kelly will see up to $15,100. In total, the 53 representatives listed in the paper will receive about $15 million in additional income each year. (It should be noted that both Rothfus and Kelly are well below average in how much extra money they will see from the loophole, compared to the other 51 representatives listed in the study.) But Kelly does sit on the Ways and Means committee in the U.S. House, which crafted the original legislation and actually proposed a bigger pass-through deduction than was eventually passed.

Nonetheless, CAP Action spokesperson Jesse Lee sent a statement to City Paper saying the outcome was corrupt because the tax bill provides direct financial benefits to those who voted for it.

“Every day we see a new example of the Republican culture of corruption, but the tax bill was the crowning achievement,” wrote Lee in a statement. “Like Trump’s cabinet, members of congress who voted for this are enriching themselves at the expense of the middle class, and they should all come clean on just how much they gave themselves.”

Requests for comments to the offices of Kelly and Rothfus went unanswered.

CAP’s study also points out that a typical employee isn't eligible for the pass-through deduction and that small business owners could have a tough time figuring out how to benefit thanks to

“a thicket of confusing new rules.”

Other Pennsylvania politicians to vote for the tax bill and see significant personal-income benefits are U.S. Rep. Tom Marino (R-Williamsport), who will get up to $15,300 in extra annual income, and U.S. Rep. Lou Barletta (R- Hazleton), who will see up to $7,650 more.

Tags: Mike Kelly , Keith Rothfus , Southwestern Pennsylvania , tax-cut bill , Center for American Progress , passthrough loophole , Sewickely , Butler , Congressional Budget Office , PolitiCrap , Image